D

Deleted member 1

Guest

The Affair of pre-1949 Chinese Debt, or just how far does the erosion of sovereignty extend?

So, the basic idea is that unlike many other regimes the Red Chinese regime has refused to honour pre-1949 debt, despite asserting that the Republic of China is illegitimate, and also since 2004 SCOTUS precedent has held that US law allows retroactive enforcement against foreign governments. In principle I oppose all of this rot because I fear the consequences of this principle for the general erosion of State Sovereignty in the world, but as a practical matter in the midst of a trade war started much later than it should have been, we are stuck with it being an interesting option for escalation. The legal arguments over this if the US Government throws its weight behind the debt being valid will be profoundly interesting, and of great national import.

The defaulted China bonds can be found in the attics and basements of thousands of Americans, or on EBay, where the certificates sell as collectibles for as little as a few hundred dollars each. The PRC, which succeeded the Republic of China after it replaced the imperial dynasty, has never recognized the debt, though that hasn’t stopped decades of attempts to collect payment on it.

Now, with Trump ratcheting up the trade rhetoricwith China, holders of the antiquarian bonds are hoping he’ll press their case, even as other parts of the U.S. government are accusing people of fraudulently selling the same paper.

Perhaps the only thing more peculiar than the story of the Chinese debt and the bid to seek payment on it, is the cast of characters drawn into its orbit. President Trump, U.S. Treasury Secretary Steven Mnuchin, and U.S. Commerce Secretary Wilbur Ross have met with bondholders and their representatives. Kirbyjon Caldwell, pastor of a Texas megachurch and spiritual adviser to George W. Bush, has been charged by the U.S securities regulator for selling the debt to elderly retirees. (Caldwell has pleaded innocent and maintains that the bonds are legitimate.)

“With President Trump, it’s a whole new ballgame,” says Jonna Bianco, a Tennessee cattle rancher who leads a group representing pre-revolutionary China bondholders and who has met with the president. “He’s an ‘America First' person. God bless him.”

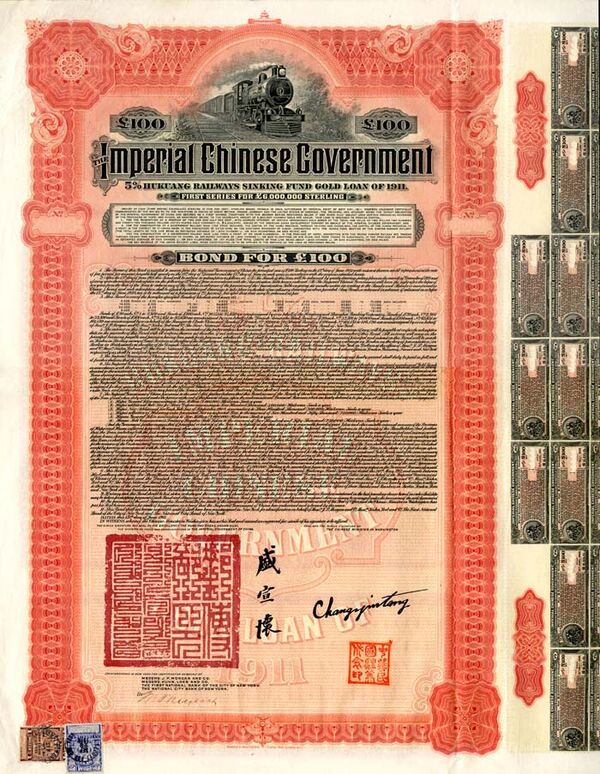

Hundreds, if not thousands, of these 5% Hukuang Railways Sinking Fund Gold Loan of 1911 bonds—issued in 1911 by a consortium of banks in London, Berlin, Paris, and New York—appear to have survived.

The Hukuang Railway bond is a thing of beauty. Printed with an ornate border and carrying a large chop, the debt was sold in 1911 to help fund construction of a rail line stretching from Hankou to Szechuan.

The U.S. once referred to the money that flowed into China at the turn of the 20th century as “dollar diplomacy”—a way of building relations with the country (and its massive untapped market) by helping it industrialize. The Chinese have another term for it: For them it fits squarely into China’s “Hundred Years of Humiliation,” when the Middle Kingdom was forced to agree to unfair foreign control.

Soon after the imperial dynasty was overthrown in 1911, the Republic of China began tapping the international capital markets for funding too. That included selling a series of gold-backed notes to fund the nascent country. It’s these bonds that Bianco, who co-founded the American Bondholders Foundation in 2001 to represent holders of pre-communist debt, is hoping could be a useful political leverage in Trump’s fight with China.

“The People’s Republic of China dismisses its defaulted sovereign obligations as pre-1949 Republic of China debt, but doing so contradicts the PRC’s claim that it is sole successor to the ROC’s sovereign rights,” Bianco said in an emailed statement in response to this story.

[...]

She argues that China is in selective default, having paid out on bonds held by British investors in 1987 as part of the Hong Kong handover deal negotiated by former Prime Minister and ‘Irony Lady’ Margaret Thatcher. If China doesn’t pay out, she says, it should be blocked from selling new debt in international markets. By Bianco’s reckoning, China now owes more than $1 trillion on the defaulted debt, once adjusted for inflation, interest, and other damages—a sum roughly equivalent to China’s holdings of U.S. Treasuries.

So, the basic idea is that unlike many other regimes the Red Chinese regime has refused to honour pre-1949 debt, despite asserting that the Republic of China is illegitimate, and also since 2004 SCOTUS precedent has held that US law allows retroactive enforcement against foreign governments. In principle I oppose all of this rot because I fear the consequences of this principle for the general erosion of State Sovereignty in the world, but as a practical matter in the midst of a trade war started much later than it should have been, we are stuck with it being an interesting option for escalation. The legal arguments over this if the US Government throws its weight behind the debt being valid will be profoundly interesting, and of great national import.